Illinois Real Estate Transfer Tax Rate . Web transfer taxes in illinois are calculated based on the sale price or property value, whichever is higher. $0.50 for every fraction of $500 in the sale price (approx. The state charges sellers $1.00 per $1,000.00 of the. Web the illinois state transfer tax. Web in illinois, property sellers, not home buyers, pay the state and county real estate transfer tax. Web counties may impose a tax of 25 cents per $500 of value on real estate transactions. Home rule municipalities may also. Web for example, according to chicago’s department of finance, the real estate transfer tax (rett) is calculated at. Web yers and sellers must pay a transfer tax. In addition to the municipal transfer tax, each county in illinois assesses a transfer tax. Varies depending on property value;

from www.hauseit.com

Web transfer taxes in illinois are calculated based on the sale price or property value, whichever is higher. Web in illinois, property sellers, not home buyers, pay the state and county real estate transfer tax. The state charges sellers $1.00 per $1,000.00 of the. Varies depending on property value; Web counties may impose a tax of 25 cents per $500 of value on real estate transactions. Web yers and sellers must pay a transfer tax. Web the illinois state transfer tax. Web for example, according to chicago’s department of finance, the real estate transfer tax (rett) is calculated at. In addition to the municipal transfer tax, each county in illinois assesses a transfer tax. Home rule municipalities may also.

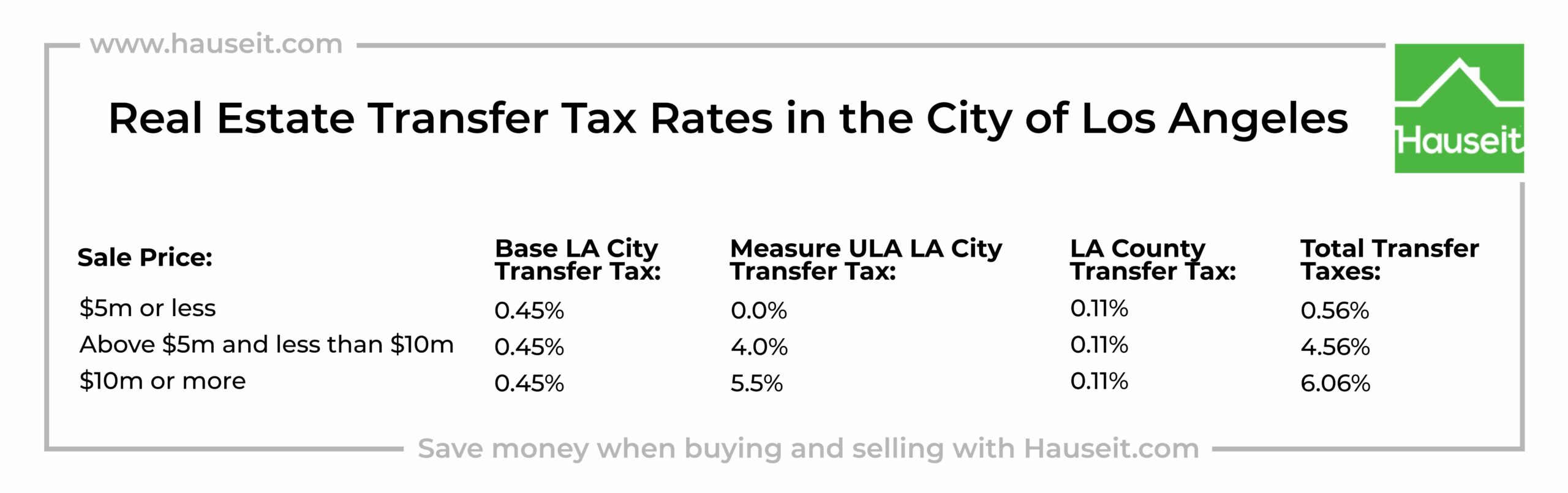

How Much Are Real Estate Transfer Taxes in Los Angeles?

Illinois Real Estate Transfer Tax Rate Varies depending on property value; Web for example, according to chicago’s department of finance, the real estate transfer tax (rett) is calculated at. Web transfer taxes in illinois are calculated based on the sale price or property value, whichever is higher. Web in illinois, property sellers, not home buyers, pay the state and county real estate transfer tax. Varies depending on property value; $0.50 for every fraction of $500 in the sale price (approx. In addition to the municipal transfer tax, each county in illinois assesses a transfer tax. Web the illinois state transfer tax. Home rule municipalities may also. Web yers and sellers must pay a transfer tax. The state charges sellers $1.00 per $1,000.00 of the. Web counties may impose a tax of 25 cents per $500 of value on real estate transactions.

From www.theoldfathergroup.com

Real Estate Transfer Tax What Are They & Where Does The Money Go Illinois Real Estate Transfer Tax Rate Web in illinois, property sellers, not home buyers, pay the state and county real estate transfer tax. Web counties may impose a tax of 25 cents per $500 of value on real estate transactions. Web the illinois state transfer tax. Web yers and sellers must pay a transfer tax. The state charges sellers $1.00 per $1,000.00 of the. Varies depending. Illinois Real Estate Transfer Tax Rate.

From www.formsbank.com

Ptax203Nr Form Illinois Real Estate Transfer Tax Payment Document Illinois Real Estate Transfer Tax Rate $0.50 for every fraction of $500 in the sale price (approx. Web yers and sellers must pay a transfer tax. Web in illinois, property sellers, not home buyers, pay the state and county real estate transfer tax. Web the illinois state transfer tax. Varies depending on property value; Web for example, according to chicago’s department of finance, the real estate. Illinois Real Estate Transfer Tax Rate.

From www.templateroller.com

Form RLG14 Download Fillable PDF or Fill Online OrderInvoice for Real Illinois Real Estate Transfer Tax Rate Web the illinois state transfer tax. Web in illinois, property sellers, not home buyers, pay the state and county real estate transfer tax. The state charges sellers $1.00 per $1,000.00 of the. Web counties may impose a tax of 25 cents per $500 of value on real estate transactions. Web transfer taxes in illinois are calculated based on the sale. Illinois Real Estate Transfer Tax Rate.

From www.templateroller.com

Village of Wheeling, Illinois Application for Real Estate Transfer Illinois Real Estate Transfer Tax Rate Web in illinois, property sellers, not home buyers, pay the state and county real estate transfer tax. The state charges sellers $1.00 per $1,000.00 of the. Varies depending on property value; In addition to the municipal transfer tax, each county in illinois assesses a transfer tax. Web counties may impose a tax of 25 cents per $500 of value on. Illinois Real Estate Transfer Tax Rate.

From www.pinterest.com

NYS and NYC Real Estate Transfer Tax Overview for NYC Nyc real estate Illinois Real Estate Transfer Tax Rate Varies depending on property value; The state charges sellers $1.00 per $1,000.00 of the. Web counties may impose a tax of 25 cents per $500 of value on real estate transactions. Web transfer taxes in illinois are calculated based on the sale price or property value, whichever is higher. In addition to the municipal transfer tax, each county in illinois. Illinois Real Estate Transfer Tax Rate.

From kamicartwright.blogspot.com

tax rates 2022 vs 2021 Kami Cartwright Illinois Real Estate Transfer Tax Rate Web yers and sellers must pay a transfer tax. Varies depending on property value; Home rule municipalities may also. In addition to the municipal transfer tax, each county in illinois assesses a transfer tax. The state charges sellers $1.00 per $1,000.00 of the. $0.50 for every fraction of $500 in the sale price (approx. Web for example, according to chicago’s. Illinois Real Estate Transfer Tax Rate.

From www.templateroller.com

City of Joliet, Illinois Real Estate Transfer Tax Declaration and Illinois Real Estate Transfer Tax Rate Web yers and sellers must pay a transfer tax. The state charges sellers $1.00 per $1,000.00 of the. Web counties may impose a tax of 25 cents per $500 of value on real estate transactions. Web transfer taxes in illinois are calculated based on the sale price or property value, whichever is higher. Web in illinois, property sellers, not home. Illinois Real Estate Transfer Tax Rate.

From www.formsbank.com

Ptax203 Form 2005 Illinois Real Estate Transfer Declaration Illinois Real Estate Transfer Tax Rate Varies depending on property value; Web the illinois state transfer tax. Web counties may impose a tax of 25 cents per $500 of value on real estate transactions. $0.50 for every fraction of $500 in the sale price (approx. Home rule municipalities may also. Web for example, according to chicago’s department of finance, the real estate transfer tax (rett) is. Illinois Real Estate Transfer Tax Rate.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Westchester County? Illinois Real Estate Transfer Tax Rate In addition to the municipal transfer tax, each county in illinois assesses a transfer tax. Web counties may impose a tax of 25 cents per $500 of value on real estate transactions. Web transfer taxes in illinois are calculated based on the sale price or property value, whichever is higher. Web for example, according to chicago’s department of finance, the. Illinois Real Estate Transfer Tax Rate.

From www.countyforms.com

Form Ptax 203 B Illinois Real Estate Transfer Declaration Illinois Real Estate Transfer Tax Rate Web the illinois state transfer tax. Home rule municipalities may also. The state charges sellers $1.00 per $1,000.00 of the. Web yers and sellers must pay a transfer tax. Web in illinois, property sellers, not home buyers, pay the state and county real estate transfer tax. Varies depending on property value; In addition to the municipal transfer tax, each county. Illinois Real Estate Transfer Tax Rate.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Westchester County? Illinois Real Estate Transfer Tax Rate In addition to the municipal transfer tax, each county in illinois assesses a transfer tax. The state charges sellers $1.00 per $1,000.00 of the. Web for example, according to chicago’s department of finance, the real estate transfer tax (rett) is calculated at. Web yers and sellers must pay a transfer tax. Web counties may impose a tax of 25 cents. Illinois Real Estate Transfer Tax Rate.

From www.templateroller.com

City of Joliet, Illinois Real Estate Transfer Tax Declaration and Illinois Real Estate Transfer Tax Rate Web for example, according to chicago’s department of finance, the real estate transfer tax (rett) is calculated at. $0.50 for every fraction of $500 in the sale price (approx. Web yers and sellers must pay a transfer tax. Web in illinois, property sellers, not home buyers, pay the state and county real estate transfer tax. Web transfer taxes in illinois. Illinois Real Estate Transfer Tax Rate.

From www.templateroller.com

City of Joliet, Illinois Real Estate Transfer Tax Declaration and Illinois Real Estate Transfer Tax Rate Web in illinois, property sellers, not home buyers, pay the state and county real estate transfer tax. In addition to the municipal transfer tax, each county in illinois assesses a transfer tax. Web counties may impose a tax of 25 cents per $500 of value on real estate transactions. Web for example, according to chicago’s department of finance, the real. Illinois Real Estate Transfer Tax Rate.

From blog.chicagocityscape.com

Three potential changes to the real estate transfer tax in Chicago by Illinois Real Estate Transfer Tax Rate $0.50 for every fraction of $500 in the sale price (approx. Web the illinois state transfer tax. Varies depending on property value; Web counties may impose a tax of 25 cents per $500 of value on real estate transactions. Web transfer taxes in illinois are calculated based on the sale price or property value, whichever is higher. Home rule municipalities. Illinois Real Estate Transfer Tax Rate.

From formdownload.org

Free Legal Forms PDF Template Form Download Illinois Real Estate Transfer Tax Rate Web counties may impose a tax of 25 cents per $500 of value on real estate transactions. Web transfer taxes in illinois are calculated based on the sale price or property value, whichever is higher. Varies depending on property value; Web in illinois, property sellers, not home buyers, pay the state and county real estate transfer tax. Home rule municipalities. Illinois Real Estate Transfer Tax Rate.

From www.formsbank.com

Real Estate Transfer Declaration Of Value printable pdf download Illinois Real Estate Transfer Tax Rate Web the illinois state transfer tax. In addition to the municipal transfer tax, each county in illinois assesses a transfer tax. Varies depending on property value; Web transfer taxes in illinois are calculated based on the sale price or property value, whichever is higher. Web for example, according to chicago’s department of finance, the real estate transfer tax (rett) is. Illinois Real Estate Transfer Tax Rate.

From www.newsncr.com

These States Have the Highest Property Tax Rates Illinois Real Estate Transfer Tax Rate Web transfer taxes in illinois are calculated based on the sale price or property value, whichever is higher. Web counties may impose a tax of 25 cents per $500 of value on real estate transactions. Web in illinois, property sellers, not home buyers, pay the state and county real estate transfer tax. Web for example, according to chicago’s department of. Illinois Real Estate Transfer Tax Rate.

From www.newcastle.loans

Real Estate Transfer Tax Calculator Chicago metro area Illinois Real Estate Transfer Tax Rate Web counties may impose a tax of 25 cents per $500 of value on real estate transactions. Varies depending on property value; Web yers and sellers must pay a transfer tax. Web transfer taxes in illinois are calculated based on the sale price or property value, whichever is higher. Web for example, according to chicago’s department of finance, the real. Illinois Real Estate Transfer Tax Rate.